Role

Sole Product DesignerTimeline

Sept. 2024 - Dec. 2024Industry

Fintech- Piggyvest: Focuses heavily on general savings plans but lacks education-focused features like graduation locks or student-specific budget categories.

- Risevest: Targets investment-oriented users but overlooks basic savings structures and day-to-day budgeting tools.

- Cowrywise: Emphasizes structured savings, yet it lacks social and group-saving features that attract younger, collaborative users.

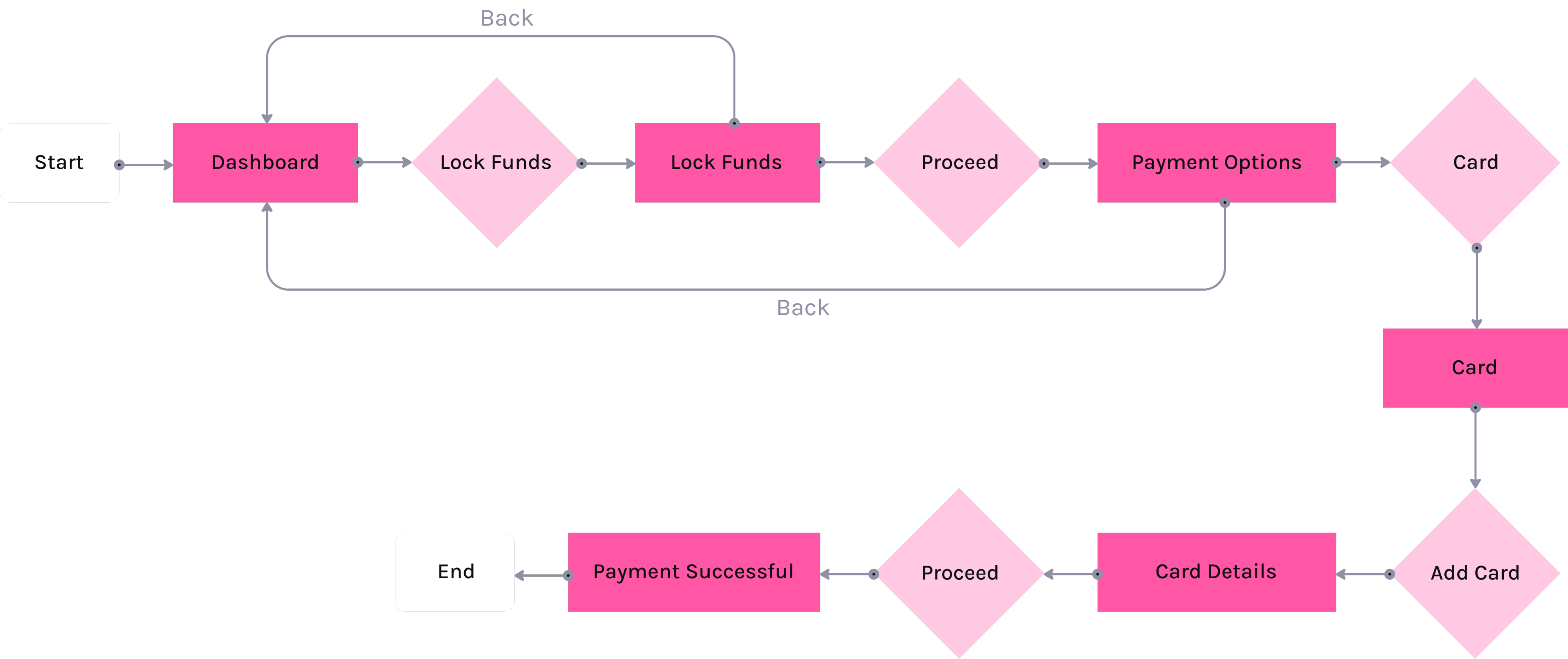

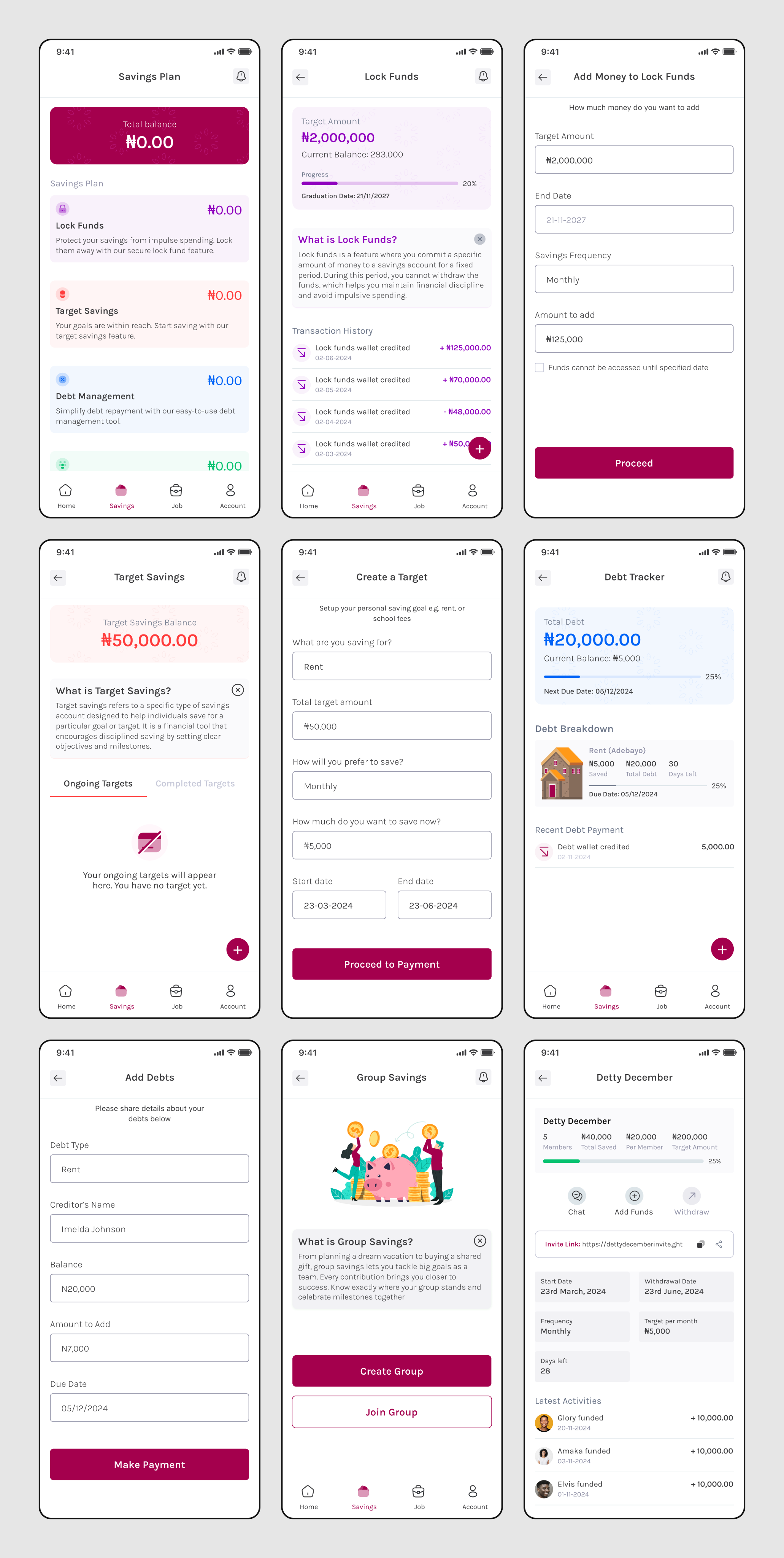

- Lock Funds Feature: Allows students to secure savings until graduation, solving impulse spending issues—a feature competitors lack.

- Group Savings: Promotes accountability and teamwork, ideal for younger, socially connected users.

- Debt Management: Tools to track and reduce debt, helping students prepare for life after graduation.

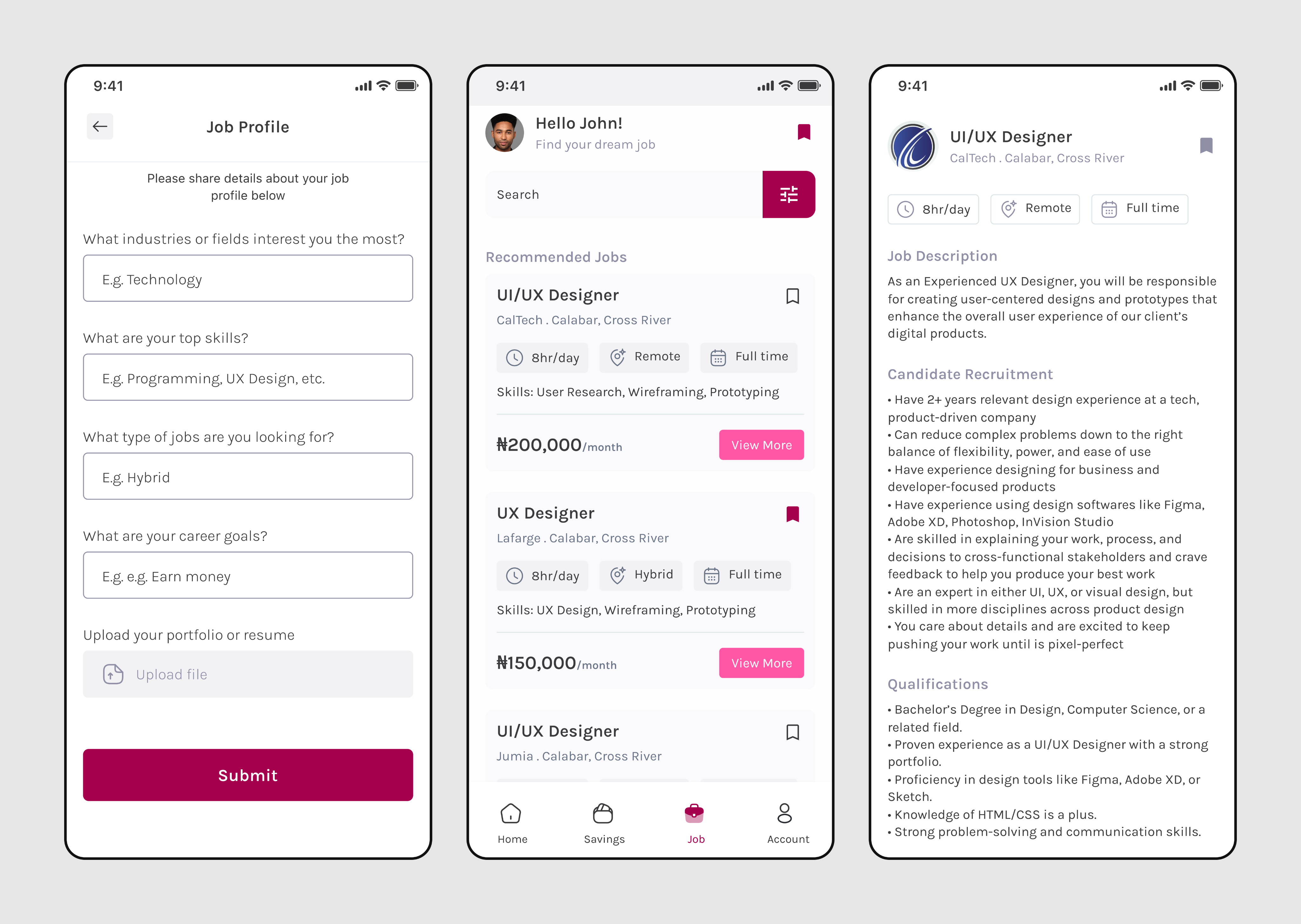

User Story

As a student, I want to lock funds until after graduation so I can avoid spending impulsivelyUser Story

As a student, I want to save with my friends toward a shared goal so we can stay accountable.User Story

As a student in debt, I want to track what I owe and plan repayments.

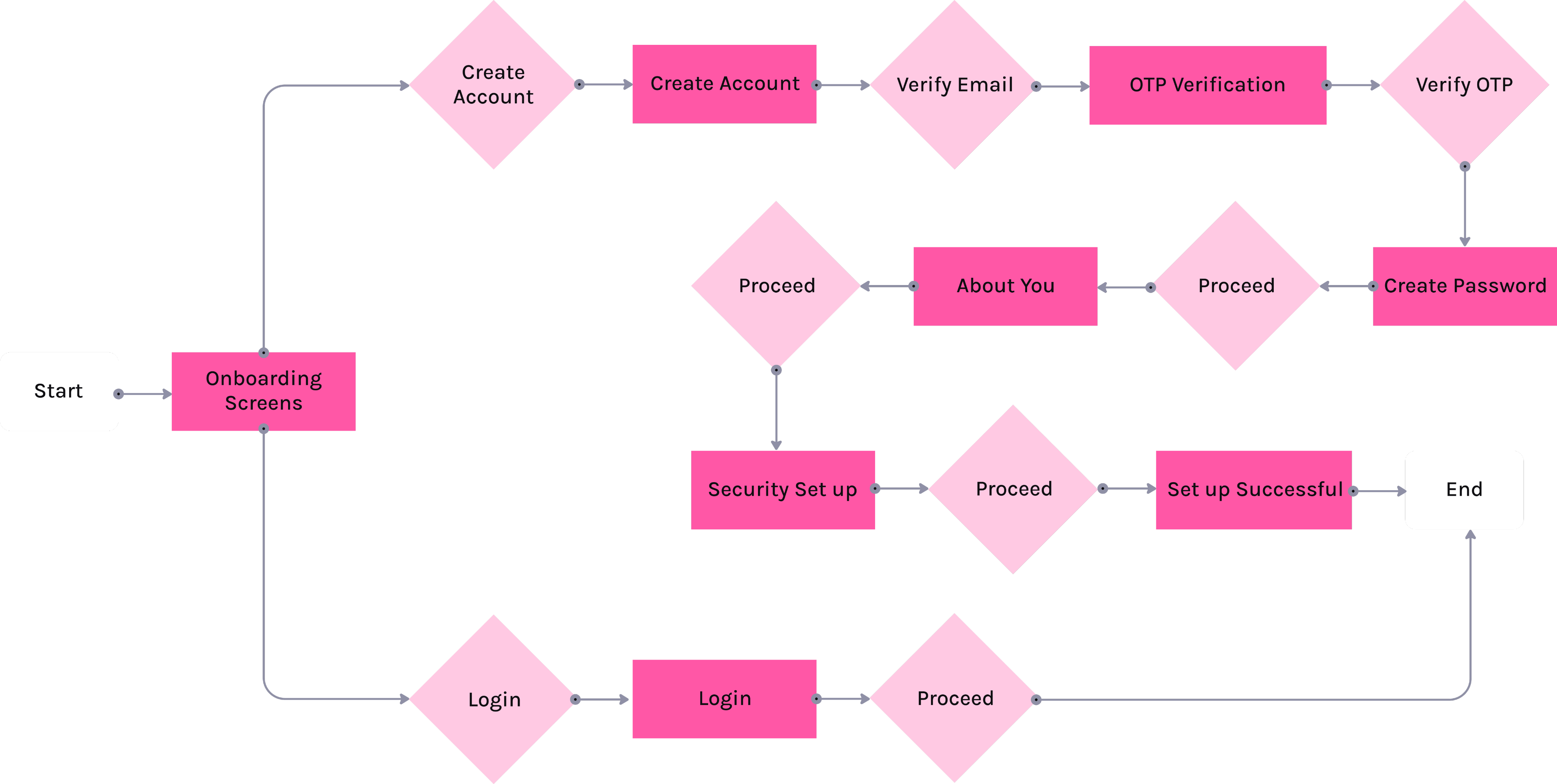

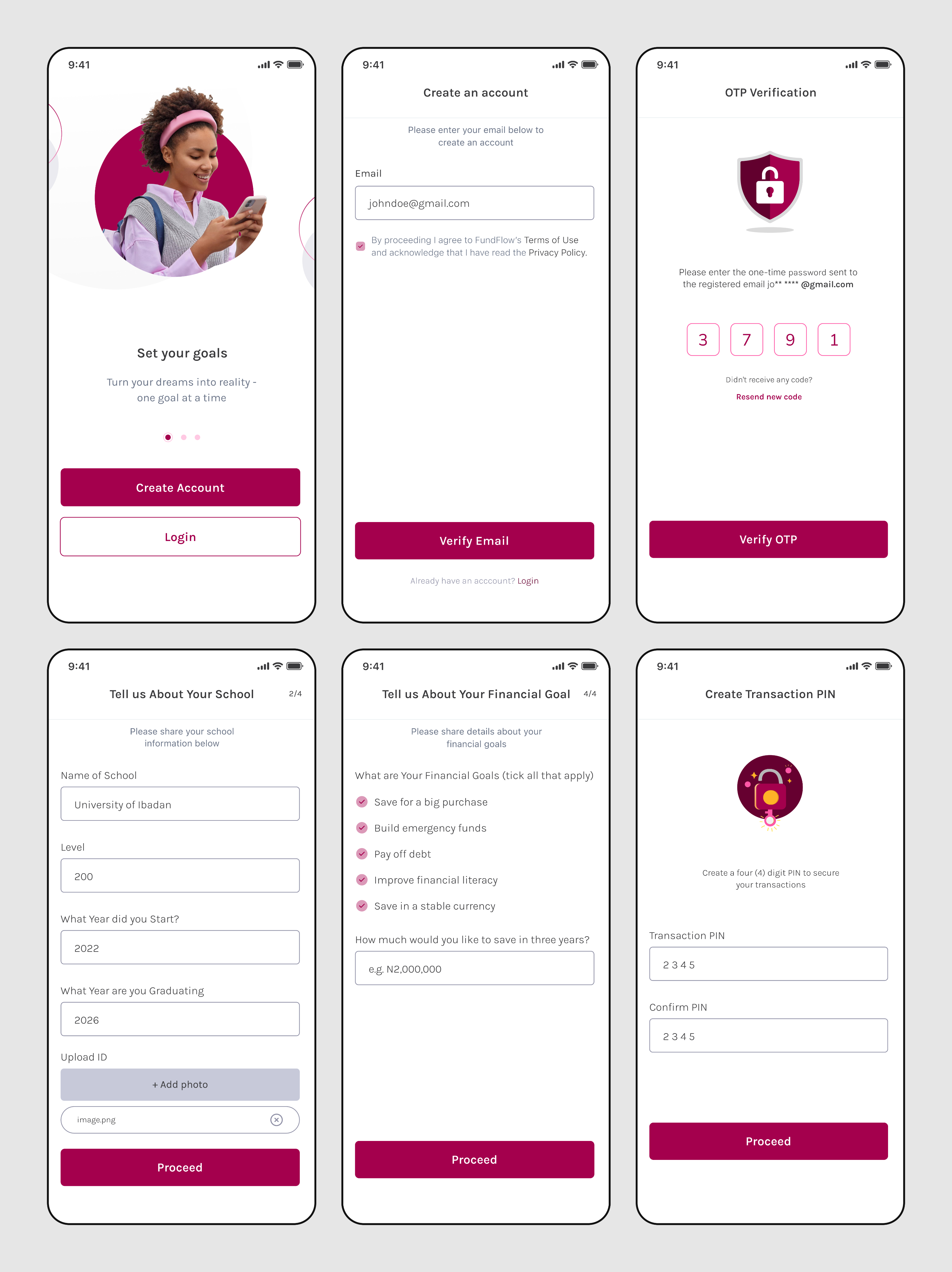

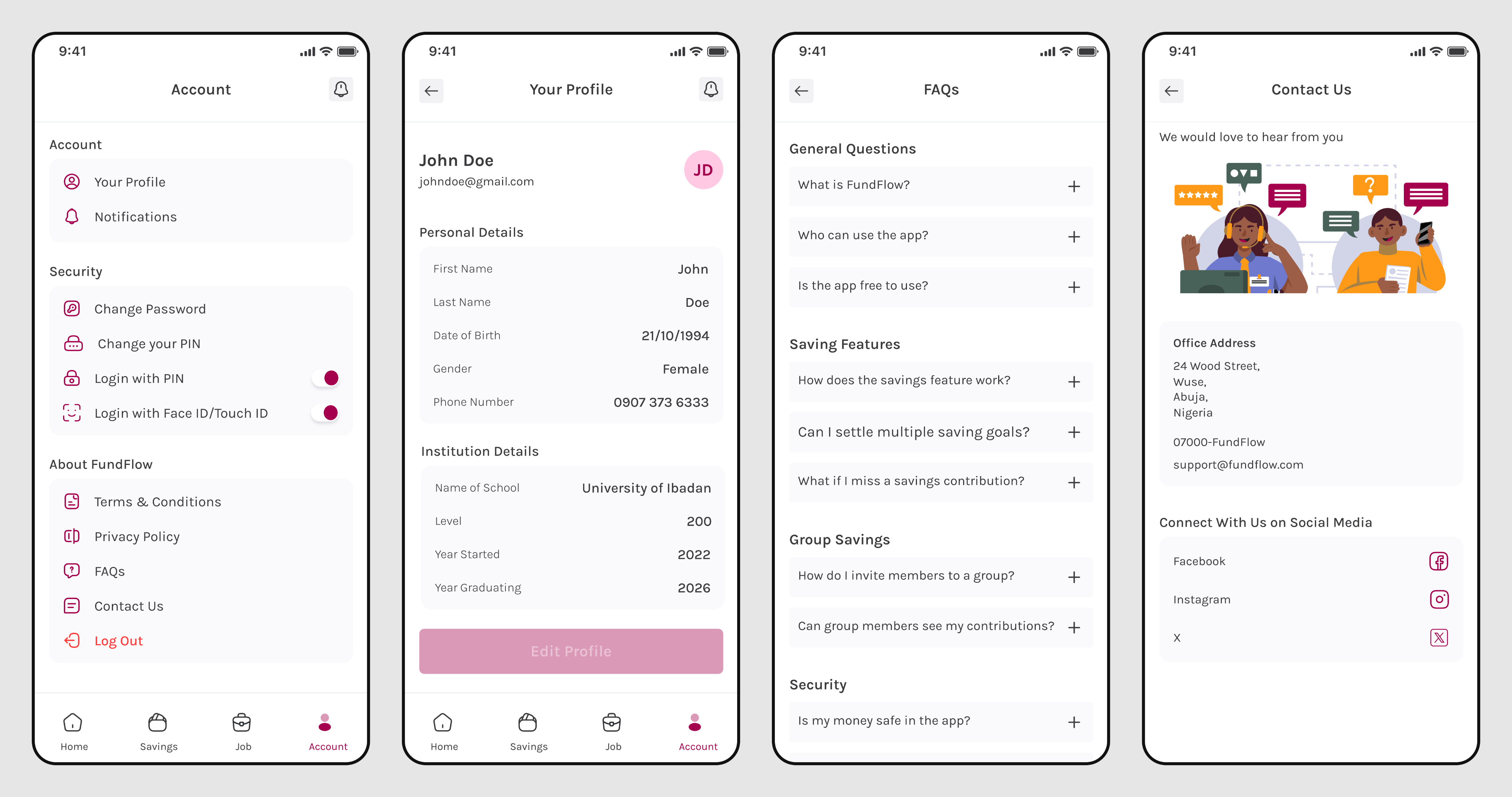

OTP Verification: Security is established through a One-Time Password (OTP) sent to the registered email address.

School Information: The app collects academic details, including the school name, current level, and start/graduating years, since it is tailored to students.

Identity Upload: Users are required to upload an image of their identification (ID) document.

Financial Goal Definition: Users define their financial goals by ticking applicable categories (e.g., save for a big purchase, improve financial literacy).

Future Savings Target: Users must specify a desired savings amount they would like to have in a set timeframe (e.g., three years).

Transaction PIN: A mandatory four-digit Transaction PIN is created to secure future transactions.

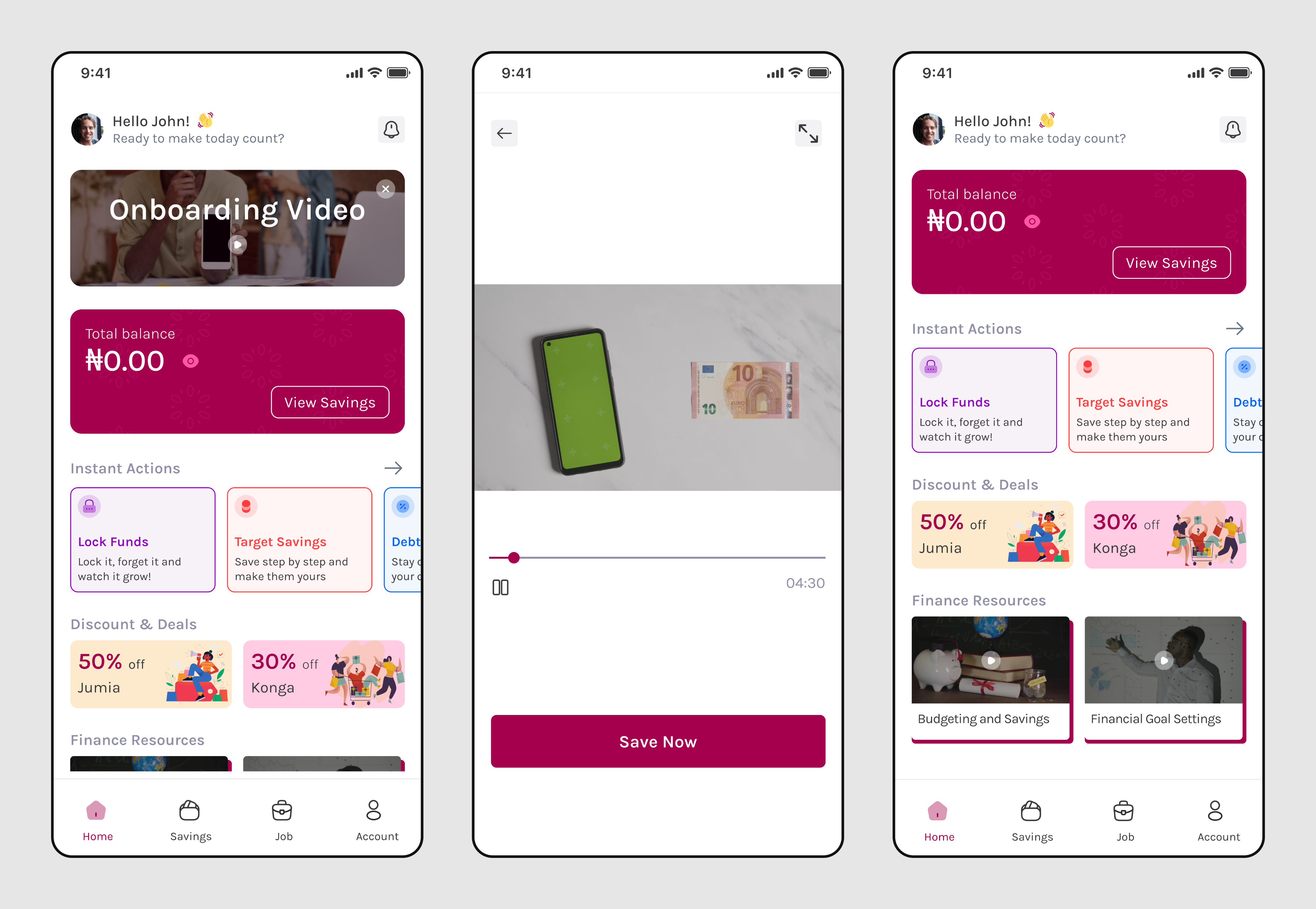

Onboarding Guide: A prominent "Onboarding Video" is displayed to guide new users.

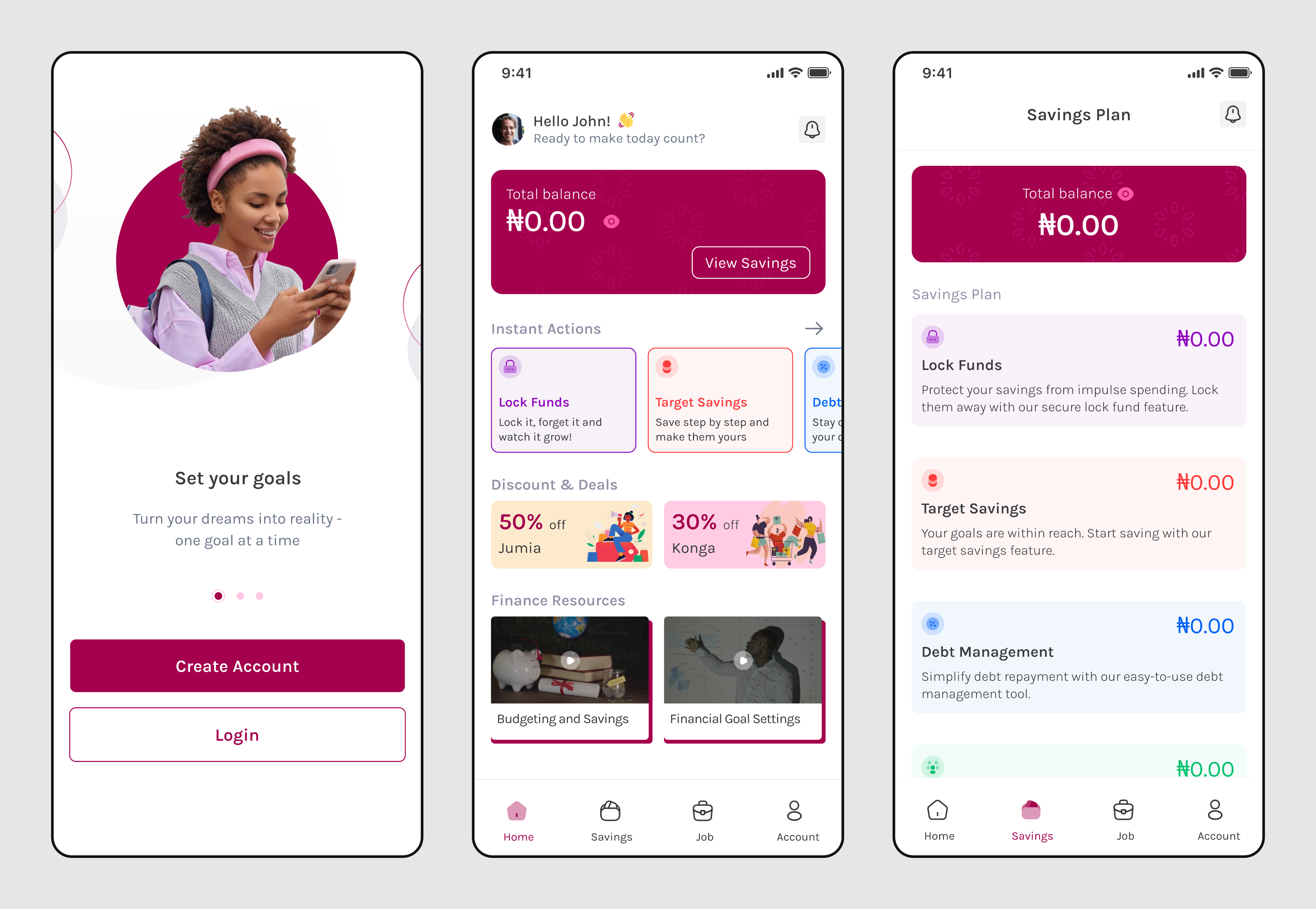

Total Balance Summary: The user's "Total balance" is visible with an immediate link to "View Savings."

Instant Access to Key Features: Quick-access cards are provided for core functions like Lock Funds, Target Savings, and Debt Management.

Incentivized Savings: A "Discount & Deals" section promote saving by offering deals from partners.

Educational Resources: A "Finance Resources" section provides links to learning materials on topics like "Budgeting and Savings" and "Financial Goal Settings."

Dedicated Savings Dashboard: The main screen provides a comprehensive overview of the total savings balance and different plan categories (Lock Funds, Target Savings, Debt Management).

Lock Funds: Users can secure savings long-term toward a specific target with a visual progress bar.

Target Savings: Users can create separate savings pots with visual tracking toward specific goals (e.g., Rent).

Debt Tracker/Management: A dedicated feature helps users track their current debt balance with a visual progress indicator.

Group Savings: A feature allows users to create or join groups to save collectively, promoting social accountability.

Project Idea

Project Direction