Role

Sole Product DesignerTimeline

August 2025 - October 2025Industry

Fintech

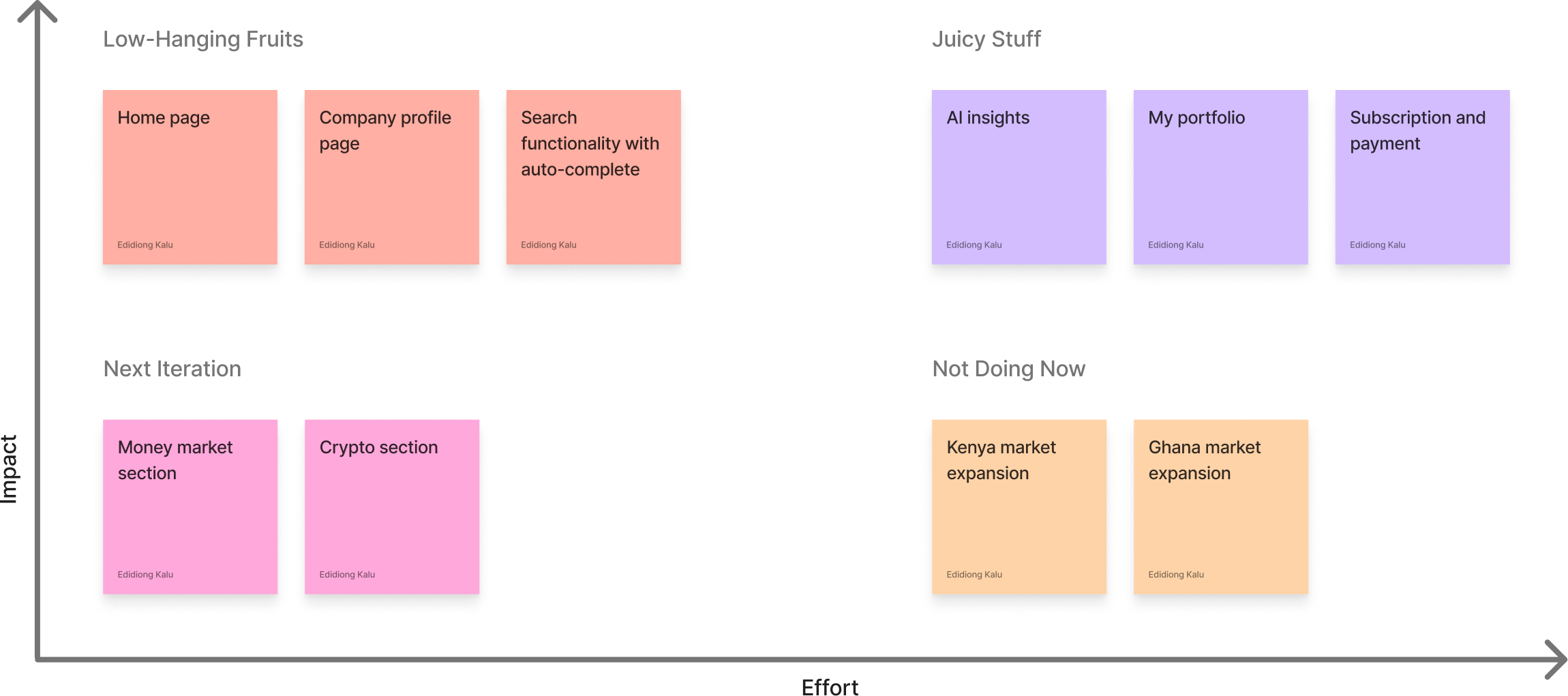

- None of the three platforms combine market access, plain-spoken insight, and localized design for everyday investors.

- NASD and NGX deliver raw data but lack user-friendly interpretation or engagement layers.

- Chaka provides a functional brokerage flow but stops short of building deeper investment understanding or long-term tracking.

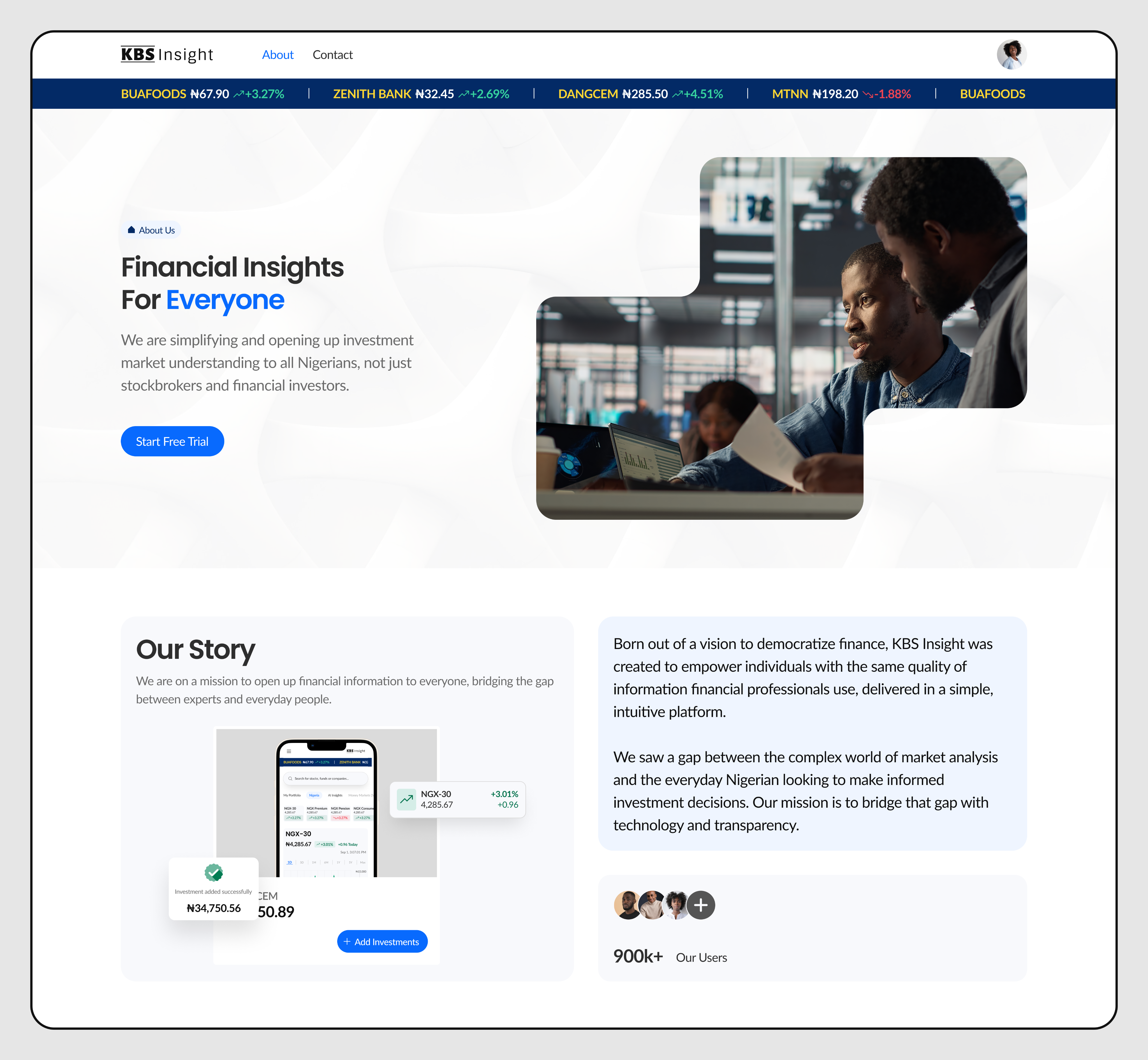

- KBS Insight can occupy the space between raw market infrastructure and trading access by offering:

a. Simplified interpretation of data (not just charts and numbers).b. Localized relevance for Nigerian retail users (Naira currency, NGX tickers, familiar UX).c. Engagement tools (portfolio tracking, AI-driven commentary, comparisons) that help demystify investing rather than add complexity.

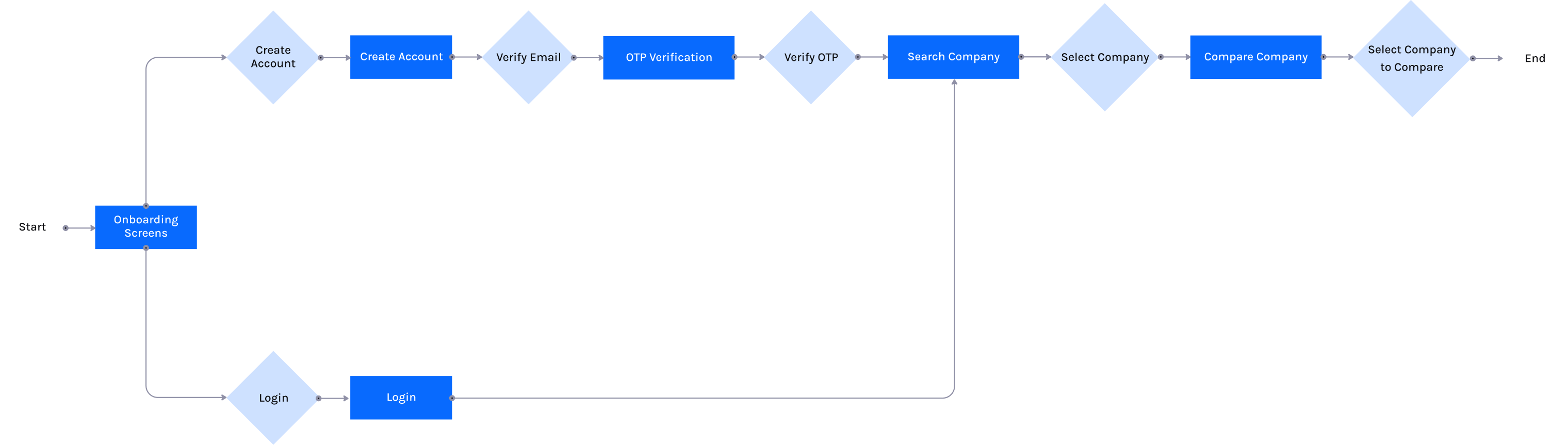

User Story

As a retail investor, I want to view the overall market performance and the latest stock prices at a glance, so I can quickly understand how the market is performing today.User Story

As a new investor, I want to search for company profiles and see their historical performance, so I can decide whether they are worth investing in.User Story

As a user with multiple holdings, I want to create my own portfolio and add investments manually, so I can track my performance in one place instead of using spreadsheets.

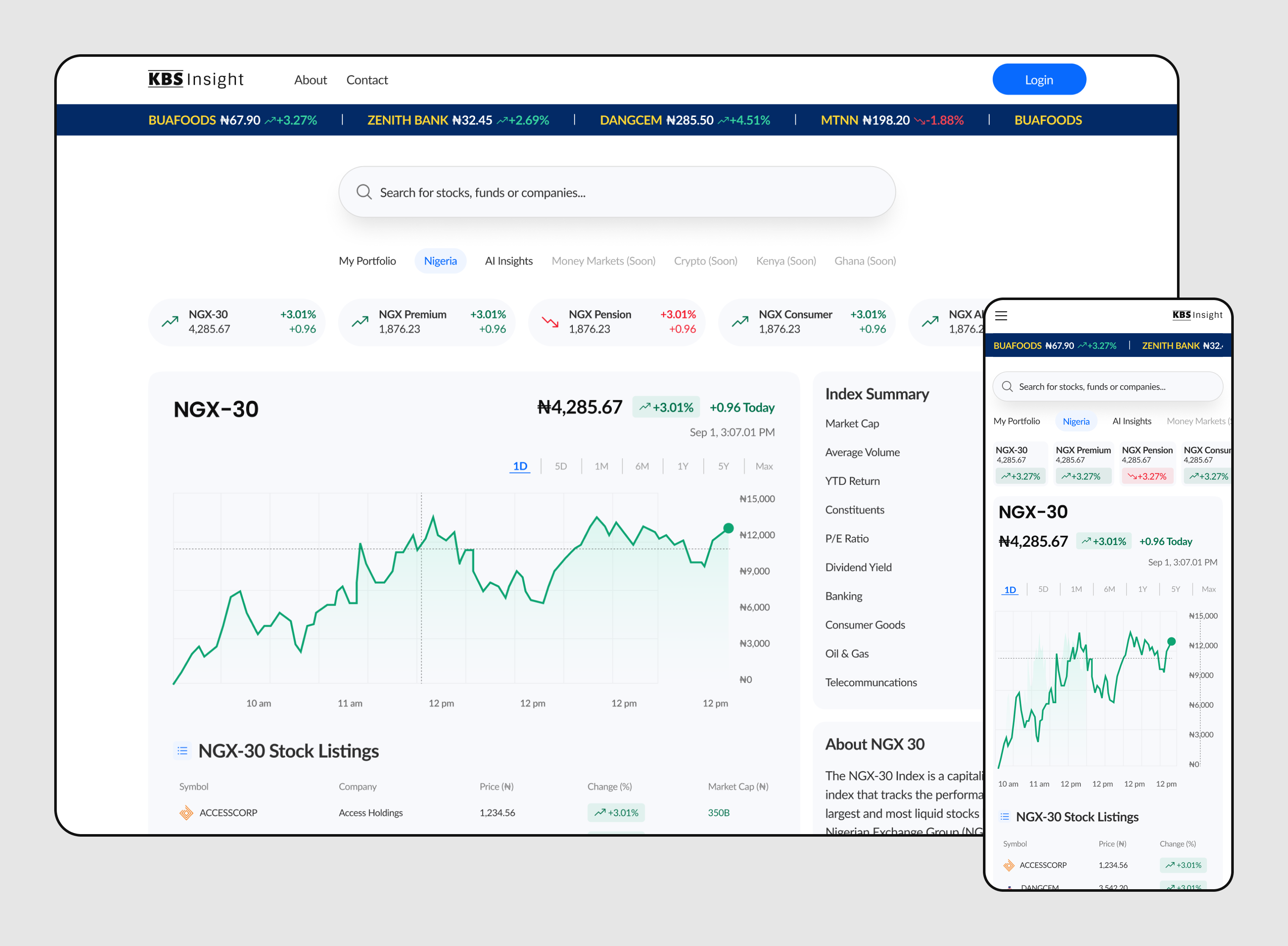

Real-Time Price Ticker: Live stock prices for major Nigerian companies (BUAFOODS, ZENITHBANK, etc.) are prominently displayed at the top.

Search Functionality: A search bar allows users to find specific stocks, funds, or companies.

Market Overview: The homepage opens with real-time performance data of major Nigerian market indices, allowing users to immediately grasp the market’s direction without extra navigation.

Dynamic Index Chart: A live, interactive chart showcases index movements throughout the day, offering users instant visual insight into market performance and trends.

Stock Listing: The stock listings under each index provide a clear, scrollable table of top-performing companies, featuring colour-coded performance indicators for easy comparison.

Index Summary: An informational sidebar summarizes key index metrics, including market cap, dividend yield, and sector distribution, giving context to the data in a simplified format.

Market News: The Market News section integrates curated headlines from credible financial sources, ensuring users stay informed on major market shifts and company-specific developments directly from the homepage.

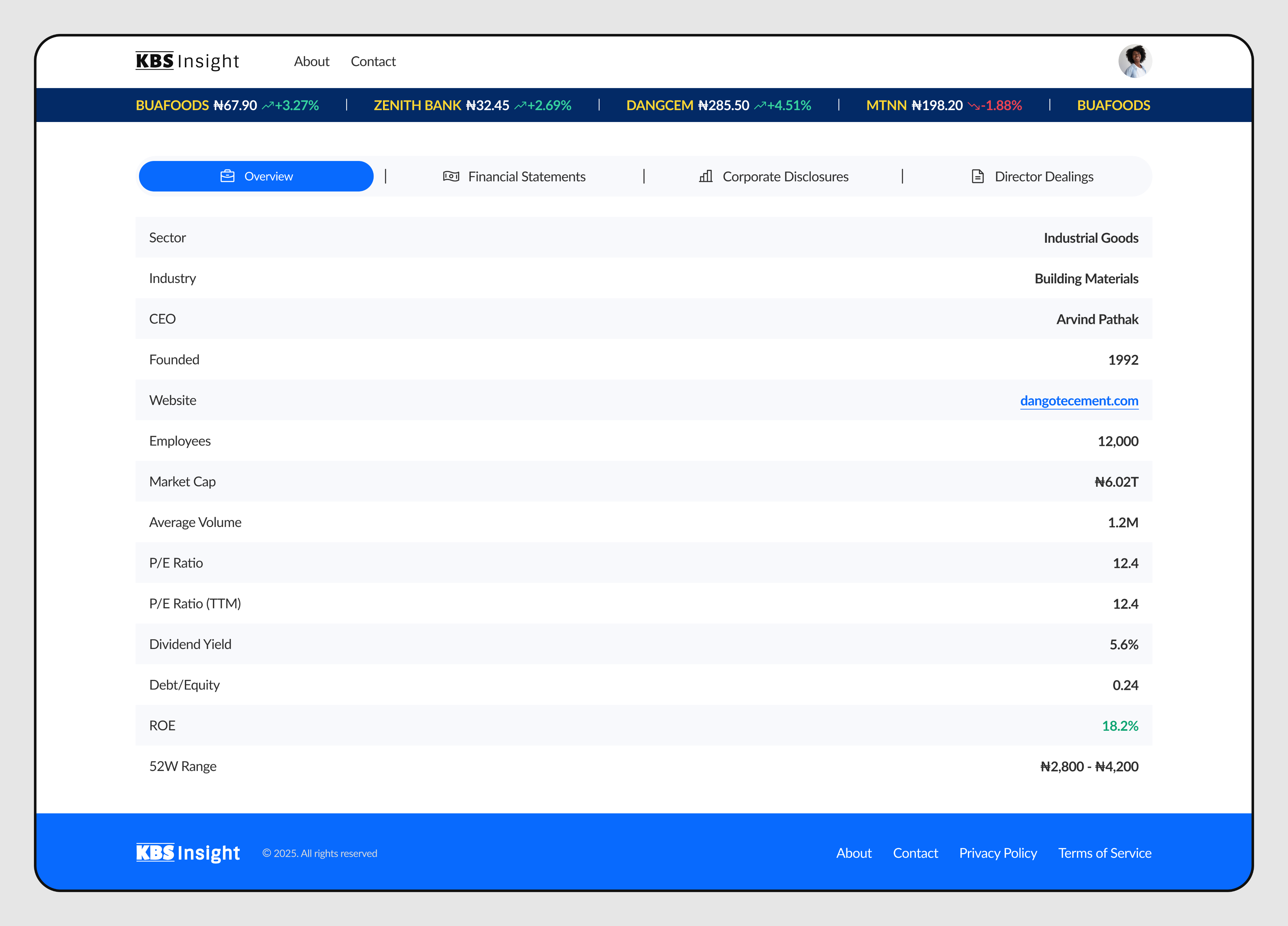

Dynamic Stock Overview: The company profile opens with a live stock chart and performance summary, giving users immediate visibility into a company’s price movement, growth rate, and overall market position.

Company Summary Sidebar: A concise summary panel presents essential financial metrics such as market cap, P/E ratio, and dividend yield, allowing users to quickly assess company strength without navigating away.

AI-Assistant Widget: The “Ask KBS Invest AI” widget lets users interact directly with the AI for personalized insights and stock analysis, integrating intelligence seamlessly into the experience.

Company-Related News: A curated news feed below the chart keeps users updated on the latest company-specific developments, blending data analysis with real-time information.

Detailed Company Data: Structured tabs like Financial Statements, Corporate Disclosures, and Director Dealings organize complex information into readable, well-structured sections for deeper exploration.

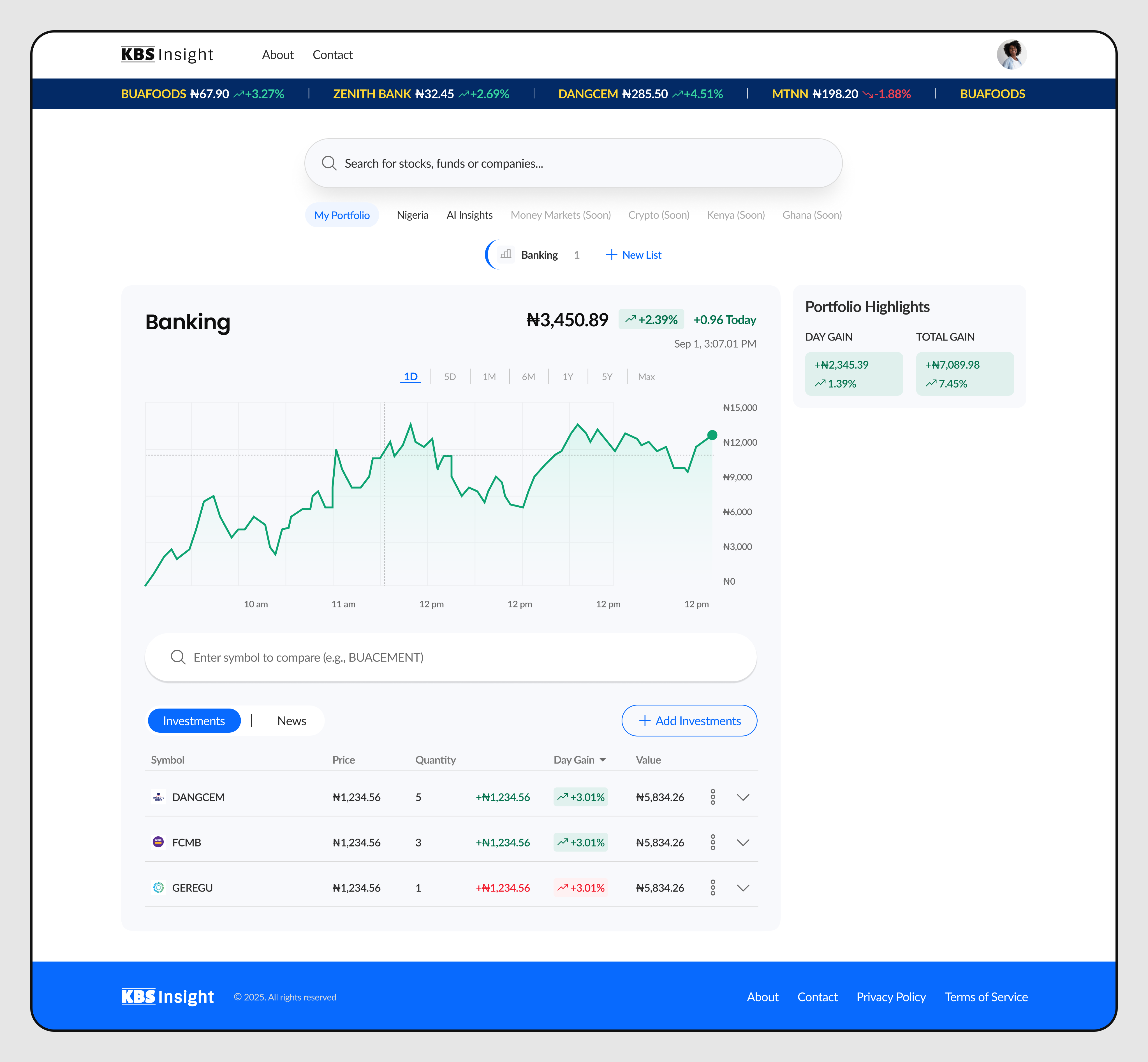

Interactive Chart: The main graph displays historical price data with customizable time ranges (1D, 5D, 1M, 6M, 1Y, 5Y, Max).

Portfolio Performance Summary: Highlights the portfolio's Total Gain and Day Gain with both monetary and percentage change.

Symbol Comparison: A dedicated field allows users to easily search for and compare the performance of other symbols (e.g., BUACEMENT).

Detailed Holding List: A table lists individual investments (DANGCEM, FCMB, GEREGU) with price, quantity, day gain, and total value.

Easy Investment Addition: A clear "+ Add Investments" button is available for users to expand their portfolio.

News Tab Integration: A dedicated tab allows users to toggle between viewing their Investments and relevant News items.

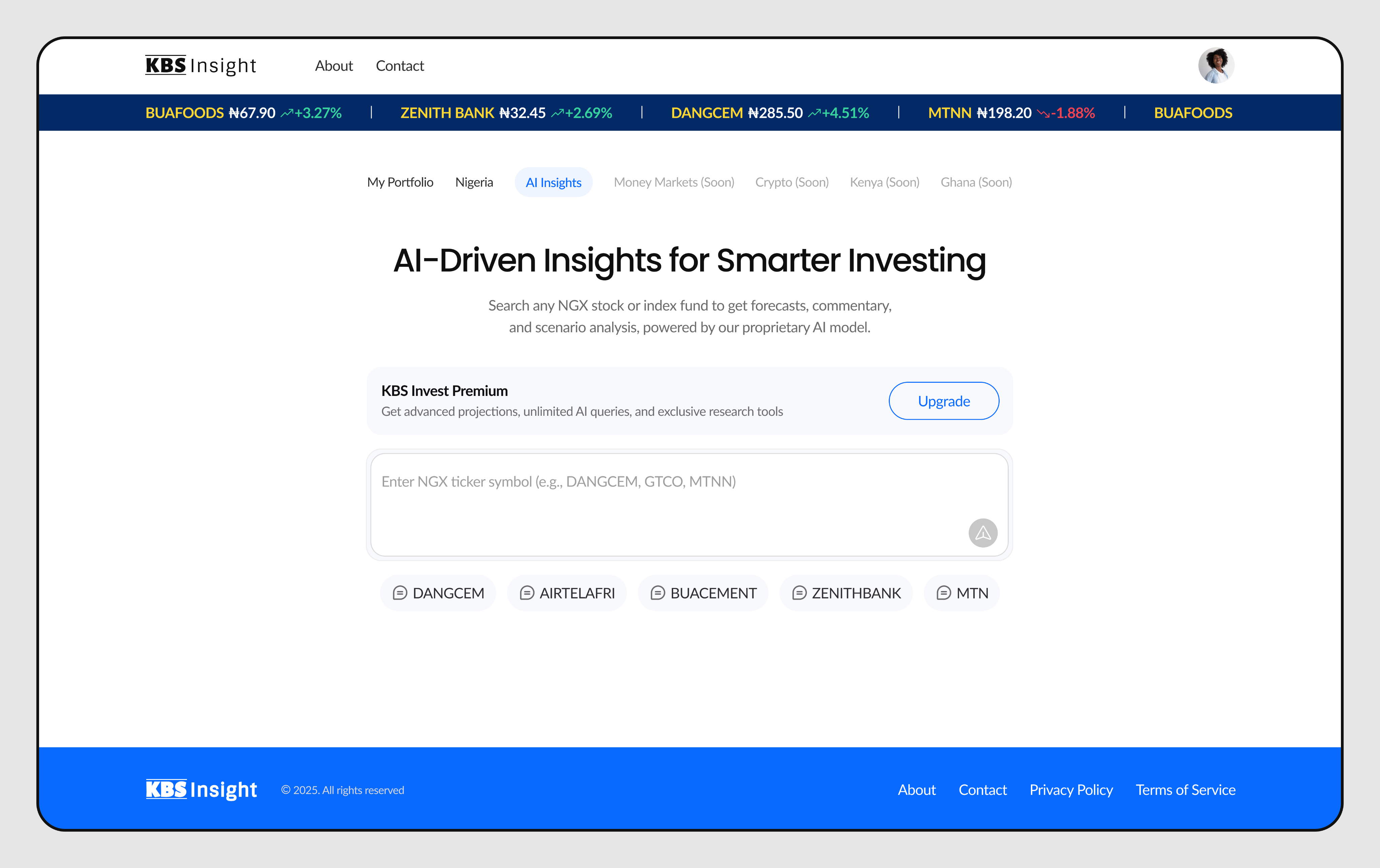

AI-Driven Core Value: The primary feature offers forecasts, commentary, and scenario analysis powered by a proprietary AI model.

Search Input: Users can search using any NGX stock or index fund ticker symbol (e.g., DANGCEM, GTCO, MTNN).

Premium Subscription: A clear call-to-action ("Upgrade") promotes KBS Invest Premium for advanced projections and unlimited AI queries.

Suggested Tickers: Quick-access buttons are provided for frequently searched or popular NGX stocks (e.g., DANGCEM, AIRTELAFRI, BUACEMENT).

Project Idea

Project Direction